santa clara county property tax rate

The median property tax in Santa Clara County California is. Yearly median tax in Santa Clara County.

Where Have Property Taxes Increased The Most Valuepenguin

The Department allocates and distributes property taxes accurately and timely to taxing entities including the County school districts cities and special districts.

. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000. Department of Tax and Collections. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022.

The Assessor is responsible for establishing assessed values used in. Residents of Santa Clara County California pay on average 4694 a year in property taxes. Supplemental assessments are designed to identify changes in assessed value either increases or decreases that occur during the fiscal year such as changes in ownership and new.

Yearly median tax in Santa Clara County. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. Three groupsCounty Assessor Controller-Treasurer and Tax Collectoradminister the Countys property taxes.

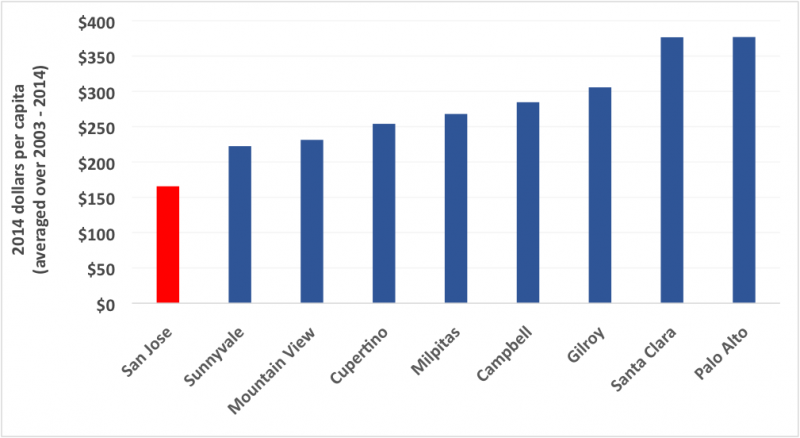

The last point is important as Santa Clara Countys government has faced recent criticism for lack of transparency in its tax rate calculations. The bills will be available online to be viewedpaid on the. The average effective property tax rate in Santa Clara County is 073.

The average effective property tax rate in Santa Clara County is 073. Campbell HS Exemptions Info and. San Jose CA 95110-1767.

The bills will be available online to be viewedpaid on the same day. Nearly all the sub-county entities have agreements for Santa Clara County to bill and collect their tax. Every entity establishes its individual tax rate.

For comparison the median home value in Santa Clara County is. Proposition 13 the property tax limitation initiative was approved by California voters in 1978. Tax rates can be complicated even without a.

When mailing a payment include the payment coupon and check. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. East Wing 6th Floor.

The budgettax rate-setting process typically. Santa Clara County collects on average 067 of a propertys. This is an average tax rate of 067 which is below the state average of 074.

If December 10 or April 10 falls on a weekend or County of Santa Clara holiday. It also performs the. Cambrian Exemptions Info and Application.

The median property tax in Santa Clara County California is. Pay secured property taxes online prior to midnight pacific time on December 10 and April 10 to avoid penalties. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000.

Santa Clara County collects on average 067 of a propertys. Property taxes are levied on land improvements and business personal property.

San Francisco Property Tax 2022 Ultimate Guide To Sf Property Tax Rates Search Payments Due Dates

State And Local Sales Tax Rates In 2017 Tax Foundation

Good News For Homeowners Property Taxes Will Barely Go Up In 2014 The Mercury News

Property Tax Collector S Office Berkeley Advanced Media Institute

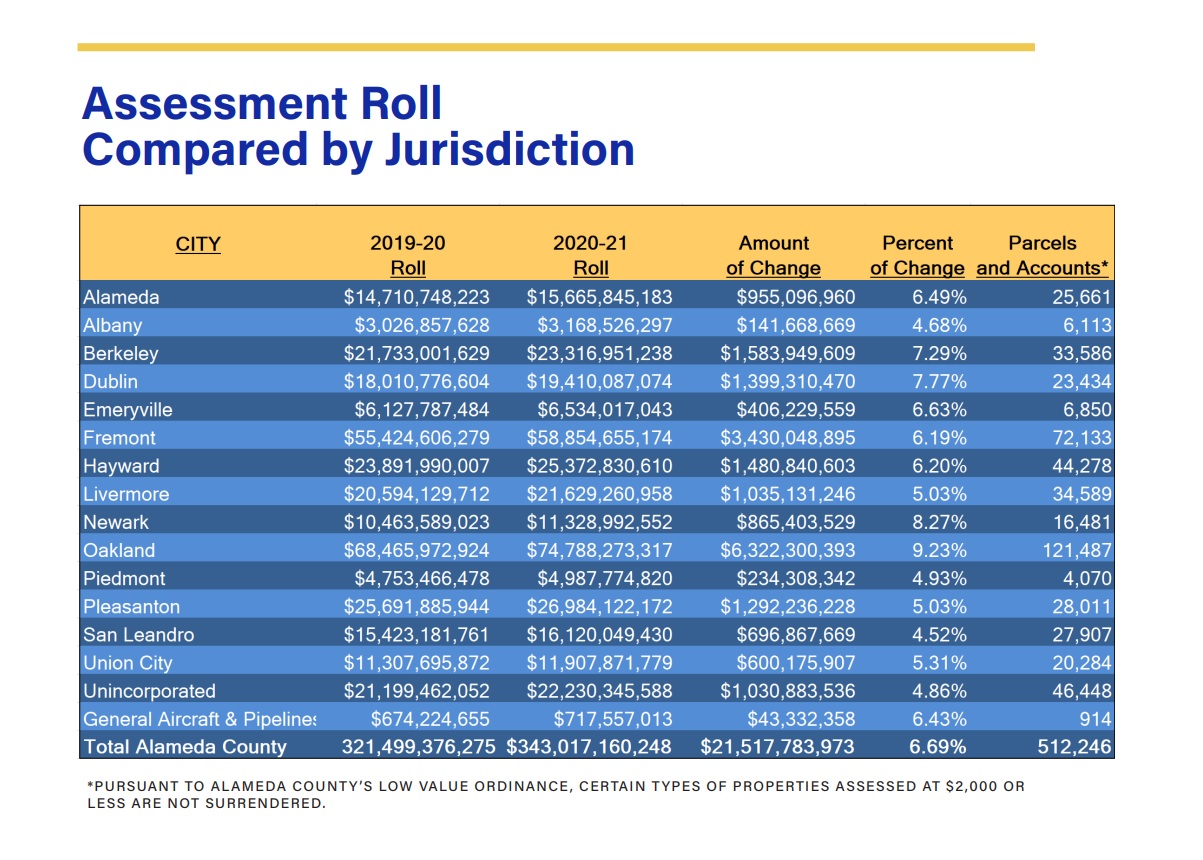

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Santa Clara County Property Taxes Due Date Ke Andrews

California Property Tax Calculator Smartasset

Santa Clara County Death Statement Fill Out And Sign Printable Pdf Template Signnow

Scam Alert County Of Santa Clara California Facebook

Strengthening The Budget Of The Bay Area S Largest City Spur

Santa Clara County Property Value Increases In 2021 San Jose Spotlight

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County California Ballot Measures Ballotpedia

The Property Tax Inheritance Exclusion

Los Angeles County Ca Property Tax Search And Records Propertyshark

Special Fund On Santa Clara County Property Tax Bill Pays For Employee Pensions The Mercury News

Good News For Homeowners Property Taxes Will Barely Go Up In 2014 The Mercury News

Op Ed Who S Exempt From Parcel Taxes In Santa Clara County San Jose Inside

Property Taxes Department Of Tax And Collections County Of Santa Clara